What Is Personal Finance and Why It Matters in 2025

Personal finance is about how you manage the money that flows through your life. It’s the balance between what you earn, what you spend, what you save, and how you grow it. In 2025, the landscape is different from even five years ago. Inflation, digital banking, and new investment opportunities like crypto and ETFs have made money management both more complex and more accessible at the same time.

Ignoring personal finance leads to stress, mounting debt, and lost opportunities. Paying attention, on the other hand, means freedom: the ability to cover emergencies, invest for growth, and plan for a future where money works for you instead of against you.

Finance isn’t just about numbers. It’s about control. A solid plan means fewer sleepless nights and more choices about how you want to live.

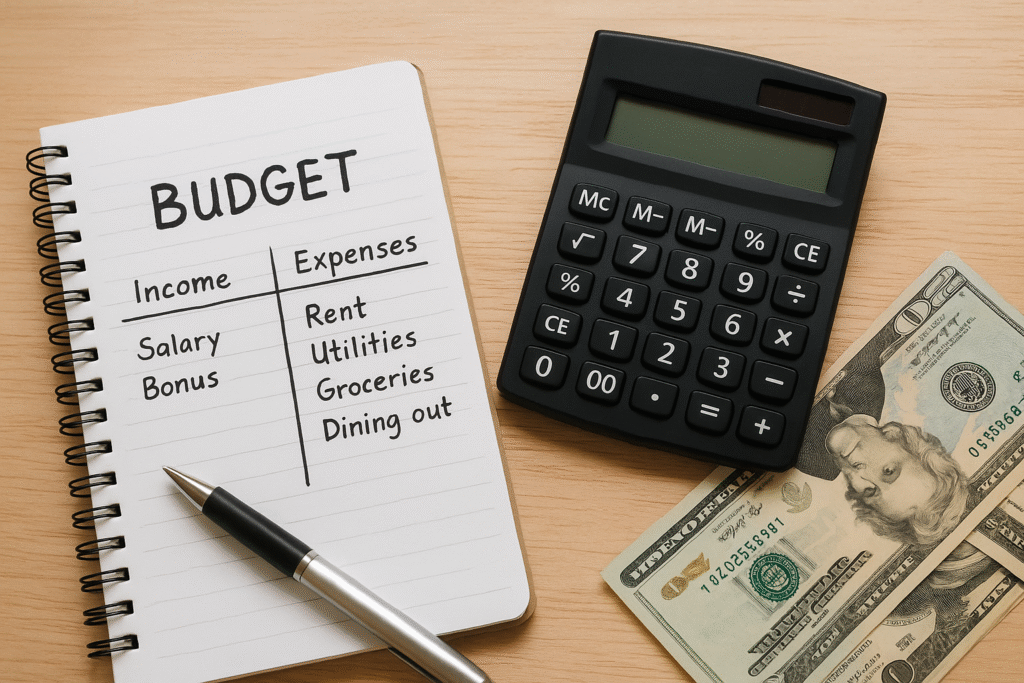

Money Management Basics: Tracking Income and Expenses

If you don’t know where your money goes, you can’t control it. That’s why tracking is the foundation of all finance. Write down every source of income, from salary to side hustles, and compare it with your expenses. Most people are shocked at how much slips away on food deliveries, subscriptions, or “small” purchases.

Apps like Mint, YNAB (You Need A Budget), and PocketGuard can automate this tracking. But even a simple spreadsheet works. The point is visibility. Once you see the flow, you can adjust it.

This is where personal finance shifts from vague ideas to real action. You’re no longer guessing—you’re measuring. And when you measure, you can improve.

Budgeting That Actually Works

Budgeting isn’t punishment. It’s a plan for making sure your money supports your life instead of draining it. One of the simplest approaches is the 50/30/20 rule:

- 50% for needs: rent, utilities, food, healthcare.

- 30% for wants: dining out, entertainment, travel.

- 20% for savings and debt repayment.

It’s flexible. If you have higher income, increase savings. If you’re in debt, adjust the percentages until the balance makes sense.

There are modern tools that simplify budgeting. Finance apps like Goodbudget or Wally sync with your accounts and categorize spending automatically. You can also check your bank’s app—many now include budgeting features built-in.

(Internal link opportunity: a future blog on “Best Finance Apps in 2025.”)

A budget that works is one you actually stick with. Don’t copy someone else’s perfect system. Build one that reflects your lifestyle.

Saving Money Without Feeling Restricted

Saving is the muscle of personal finance. Without it, every paycheck slips through your fingers. The goal isn’t to hoard—it’s to build a cushion that gives you room to breathe.

Start with an emergency fund. Aim for three to six months of essential expenses. This fund protects you from surprises like medical bills or sudden job loss.

Next, use a high-yield savings account (HYSA). Traditional banks might offer 0.1% interest, while online banks can offer over 4% in 2025. That difference adds up over time.

Automatic transfers help too. Set up your bank so a portion of income goes directly into savings. You won’t miss what you never see.

Saving doesn’t mean giving up everything fun. It means building space for the future while still enjoying the present.

How to Build Credit and Why It Matters

Your credit score is your financial reputation. Lenders, landlords, and sometimes even employers look at it to judge whether they can trust you. A higher score means better loan rates, easier approvals, and long-term savings.

To build credit:

- Pay bills on time. Payment history makes up the largest chunk of your score.

- Keep credit utilization low. Don’t max out cards. Staying under 30% of your limit is ideal.

- Avoid unnecessary new accounts. Too many applications at once lower your score.

- Check your reports. Use free annual credit report services to spot errors.

Treat credit like a tool, not free money. Handled wisely, it opens doors. Handled carelessly, it traps you.

Loans and Debt: Handle Them Without Stress

Debt isn’t always bad. Student loans, mortgages, or even a business loan can be strategic if they support growth. The danger lies in high-interest debt like credit cards and payday loans.

The key is balance. Pay high-interest debt first. Use strategies like the avalanche method (tackle highest interest first) or the snowball method (clear smallest debts first for momentum).

Refinancing and consolidating can lower your interest rates, making repayment faster. But don’t mistake refinancing as a license to borrow more.

The smartest financial move is to borrow intentionally. Ask: will this loan increase my earning potential or quality of life in a lasting way? If not, reconsider.

Investing for Beginners in 2025

Saving protects your money. Investing grows it. The earlier you start, the more compound interest does the heavy lifting.

Here are core options in 2025:

- Stocks and ETFs: Fractional shares now make investing accessible to anyone with even $10.

- Mutual Funds: A simple choice if you want diversification managed for you.

- Bonds: Lower risk, steady returns, good for balance.

- Cryptocurrency: Still volatile, but increasingly mainstream. Only invest what you can afford to lose.

Use platforms like Vanguard, Fidelity, or Robinhood for stocks and ETFs. For crypto, stick to regulated exchanges like Coinbase or Binance.

Don’t chase trends. Stick with long-term strategies. Time in the market beats timing the market.

Financial Freedom: What It Really Takes

Financial freedom isn’t about being rich. It’s about not depending on every paycheck. It means having savings, investments, and possibly passive income streams that cover your lifestyle.

Steps toward it:

- Build a solid emergency fund.

- Eliminate high-interest debt.

- Invest consistently, even if it’s small amounts.

- Explore passive income: dividends, real estate, digital products, and side hustles.

Freedom doesn’t happen overnight. It’s a result of steady, intentional decisions stacked over years.

Common Finance Mistakes to Avoid in Your 20s and 30s

- Ignoring budgets and living paycheck to paycheck.

- Using credit like free money.

- Delaying saving until “later.”

- Not learning the basics of investing early.

- Overcommitting to loans without understanding the terms.

These mistakes compound just like good habits do. Catch them early and you’ll save years of stress.

Practical Tools and Resources for Smarter Finance

Knowledge is power, but tools make it practical. A few trusted resources:

- Investopedia (https://www.investopedia.com/)—clear explanations for finance terms.

- NerdWallet (https://www.nerdwallet.com/)—comparisons of cards, accounts, and loans.

- Government sites like Consumer Finance Protection Bureau — unbiased resources for managing money and avoiding scams.

Pair these with your own discipline and you have a toolkit for life.

(Internal link idea: connect this section with your upcoming blogs on “Free Apps,” “Online Work,” and “Money Tools.”)

Conclusion: Start Small, Stay Consistent, Grow Big

Personal finance isn’t mastered overnight. It’s built step by step. Track your spending, set a budget, save steadily, build credit, handle debt wisely, and invest for the future.

The earlier you start, the easier it becomes. In 2025, opportunities are wide open—digital tools, high-yield accounts, and accessible investments give you more control than ever. The choice is whether you’ll take it.

Hi there, just changed into aware of your blog via Google, and located that it’s truly informative. I’m going to watch out for brussels. I will appreciate if you proceed this in future. Lots of people might be benefited out of your writing. Cheers!

Another issue is that video games are usually serious anyway with the most important focus on learning rather than enjoyment. Although, there’s an entertainment factor to keep your kids engaged, each one game is often designed to focus on a specific experience or programs, such as mathmatical or technology. Thanks for your write-up.

Hello there, just became aware of your blog through Google, and found that it is really informative. I’m gonna watch out for brussels. I will be grateful if you continue this in future. A lot of people will be benefited from your writing. Cheers!